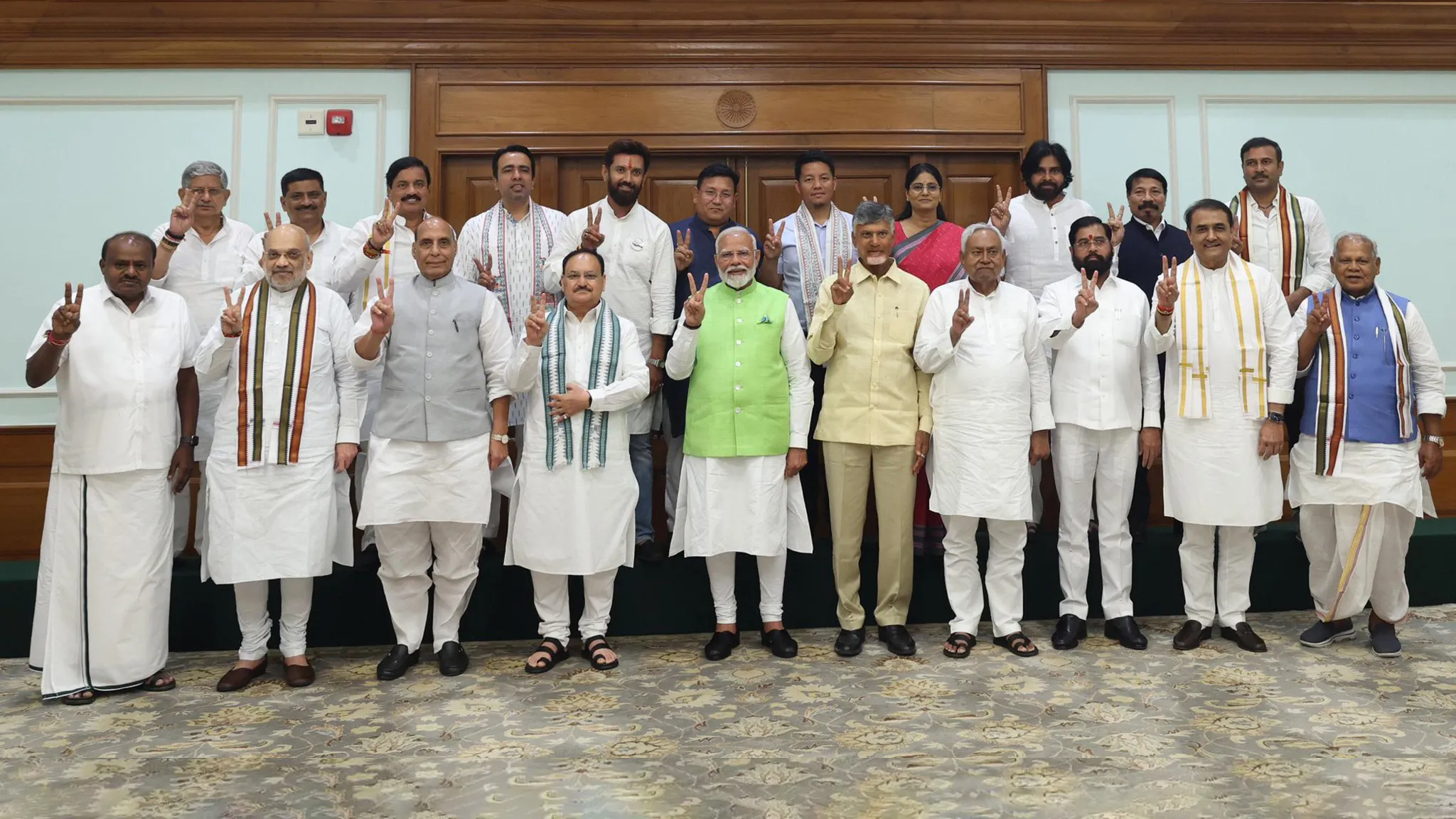

All eyes are now on the incoming BJP-led coalition government as it prepares to take the oath next week. Investors and economists alike are keen to understand the economic agenda, particularly in light of the recent election results. The Bharatiya Janata Party’s (BJP) reduced majority, especially due to losses in rural constituencies, has put the spotlight firmly on the issue of rural distress and weak consumption.

Rural Reality Bites

The primary cause for the BJP’s setback is widely believed to be the squeeze on rural incomes. Inflation, driving up prices of essential consumer goods, coupled with stagnant purchasing power in rural areas, has hampered economic recovery post-pandemic. Unlike urban centres, rural India’s economic engine has sputtered, impacting mass consumption. While discretionary spending in urban areas saw growth, as evidenced by increased sales of premium goods, mass consumption has lagged significantly. The disappointing growth in the FMCG sector over the past decade reflects this broader consumption weakness.

Recent reports from consumer intelligence firm NIQ, however, offer a glimmer of hope. Rural consumption reportedly grew at 7.6 per cent in the first quarter of calendar year 2024, surpassing urban growth of 5.7 per cent. This is a welcome shift from the previous quarter, but the crucial question remains: is this upturn sustainable, or merely a temporary blip? The rural economy, home to two-thirds of the nation’s population, requires more than just fleeting growth to regain robust health.

Policy Pivot Needed?

The central question is whether the new government will re-orient its economic strategy towards boosting consumption, rather than solely focusing on infrastructure and capital expenditure. Past policies, while not entirely neglecting consumption, banked on infrastructure investments to indirectly stimulate demand. This strategy has not yielded the desired consumption growth, possibly delayed by the pandemic, as some economists argue. Brokerage reports suggest the government might possess some fiscal room to increase social spending. Adding to the positive signals, monsoon forecasts are favourable, and the El-Nino effect is weakening, which could boost agricultural incomes.

However, challenges persist. Reservoir levels remain below the 10-year average, and generating non-farm rural income and employment is critical for sustainable consumption growth. The push towards a future-fit economy, driven by digitisation, could paradoxically limit job creation, further complicating the rural income scenario. The underperformance of the FMCG sector in the stock markets serves as a stark reminder of the consumption headwinds.

SEBI Boost for Masses

In related news, the Securities and Exchange Board of India (SEBI) has proposed to increase the investment limit for Basic Service Demat Accounts (BSDAs) from ₹2 lakh to ₹10 lakh. This move aims to encourage greater participation of small investors in the stock market by making it more cost-effective. With reduced or no annual fees for accounts up to ₹10 lakh, this initiative could potentially channel more retail investment into the market. While not a direct solution to rural consumption woes, it broadens financial inclusion and offers a platform for wider economic participation.

Will these measures be enough to truly revive mass consumption and propel the Indian economy to a higher growth trajectory? Investors should closely monitor FMCG sales volumes for sustained growth, a key indicator of a genuine consumption revival. For now, a wait-and-see approach, observing the government’s policy announcements and the monsoon’s progress, seems prudent.

Image Courtesy: X (Dr Ranjan)

Leave a Reply