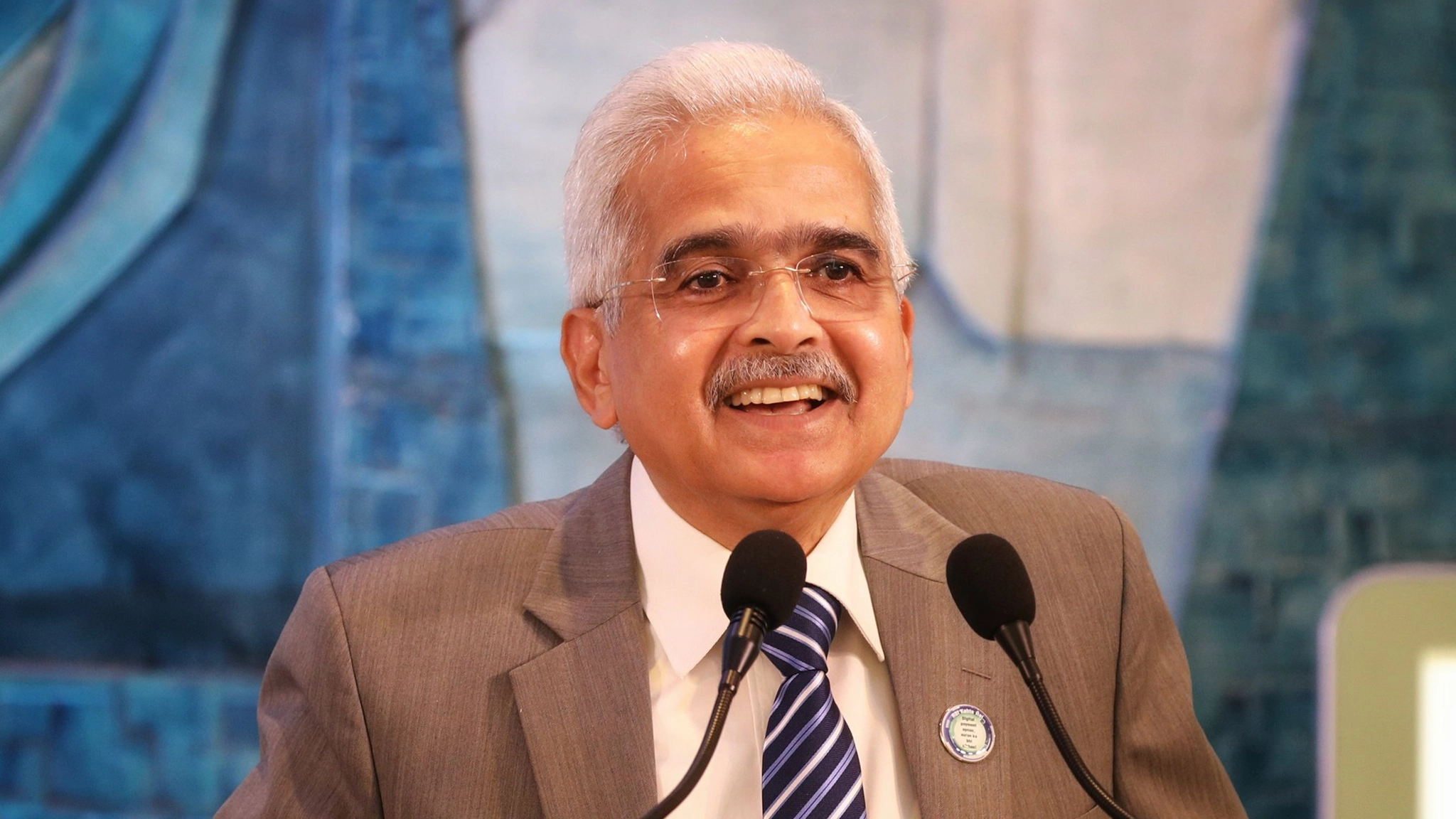

Reserve Bank of India (RBI) Governor Shaktikanta Das, addressing the Bombay Chamber of Commerce, likened managing inflation to a game of chess, cautioning against missteps. His remarks, available on Business Standard, underscore the central bank’s unwavering focus on price stability, even as voices within the Monetary Policy Committee (MPC) suggest a need to reassess the current high interest rate regime.

Governor Das Sticks to Caution

Governor Das’s stance isn’t novel; it echoes his consistent emphasis on taming inflation. However, it gains significance against the backdrop of dissent within the MPC. Two members now openly question if real interest rates are excessively high, with Jayanth Varma arguing they impose an unacceptable cost on economic growth. While Das envisions India on the cusp of sustained 8 percent GDP growth, he simultaneously flags the sluggish pace of disinflation and the ever-present threat of weather-induced inflation spikes. His priority appears clear: inflation remains the primary adversary.

Market Rates Send Different Signals

Contrasting the RBI’s cautious approach, market indicators paint a somewhat different picture. Ten-year government bond yields, currently around 7 percent, are notably lower than the 7.45 percent seen in June 2022, when the repo rate was considerably lower at 4.9 percent (compared to today’s 6.5 percent). Corporate bond yields for AAA and AA rated paper also reflect this easing. Bank lending rates, too, are below pre-pandemic levels of September 2019. The buoyant equity and IPO markets, including the SME segment, further suggest that high interest rates aren’t currently stifling economic activity. Corporate balance sheets also appear healthy. Data from CMIE indicates a comfortable interest cover for listed non-financial firms and low debt-to-equity ratios.

SBI Bond Boosts Infra Funding

Adding to the positive financial undertones, State Bank of India’s (SBI) recent infrastructure bond issuance witnessed a resounding success, raising ₹10,000 crore. Oversubscribed nearly four times, the issuance at a coupon rate of 7.36 percent signals strong investor appetite and confidence. These funds are earmarked for infrastructure and affordable housing projects, crucial sectors for long-term economic expansion. SBI Chairman Dinesh Khara highlighted the issuance’s role in fostering a longer-term bond market, which is vital for sustained infrastructure development. This successful bond raise, coupled with Kogta Financial’s fundraise of $148 million, indicates a healthy flow of capital in certain pockets of the economy.

Will the RBI acknowledge these market signals? While Governor Das remains steadfast on inflation control, the robust bond market and healthy corporate financials might eventually nudge the central bank towards a more growth-accommodative stance in the coming months. The interplay between inflation anxieties and growth imperatives will continue to shape monetary policy.

Image Courtesy: X (RBI)

Leave a Reply