The year is drawing to a close, and while many eagerly await festive fireworks, India’s Reserve Bank of India (RBI) finds itself in a situation where literal fireworks – in the form of interest rate cuts – are off the table. With GDP growth at a seven-quarter low and retail inflation stubbornly above the mandated 6 percent upper limit, grand gestures are imprudent.

Confetti over Fireworks

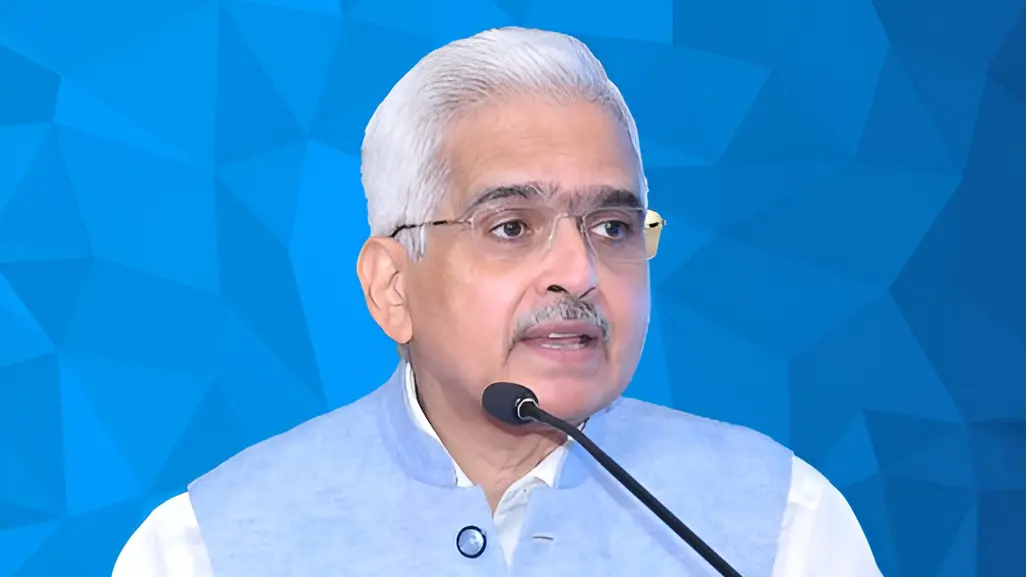

Instead of a rate cut, Governor Shaktikanta Das has opted for a more measured approach: a cut in the cash reserve ratio (CRR). This move, akin to showering confetti rather than launching rockets, will inject ₹1.16 lakh crore into the banking system. This liquidity infusion is designed to lower borrowing costs and maintain market optimism without the inflationary risk of a rate cut. As analysts have pointed out, reducing the repo rate with inflation above 6 percent would undermine the Monetary Policy Committee’s commitment to inflation targeting. This liquidity injection also provides a buffer against rupee outflows from forex interventions, allowing the RBI to manage exchange rate volatility without excessively depleting reserves or raising rates. The RBI’s revised GDP growth forecast, down to 6.6 percent for FY25, suggests that while rate cuts are not imminent, the groundwork is being laid for potential easing in the future, perhaps as early as February.

UPI Credit for Small Banks

In a parallel development, the RBI has expanded the reach of digital credit by allowing Small Finance Banks (SFBs) to offer pre-sanctioned credit lines through the Unified Payments Interface (UPI). This is a significant step towards financial inclusion, particularly for “new-to-credit” customers and underserved segments like small businesses and micro-entrepreneurs in rural and semi-urban areas. SFBs, with their low-cost, high-tech models, are ideally positioned to reach the last mile and extend credit to those traditionally excluded from formal financial systems. By integrating credit lines with UPI, the RBI is simplifying access to low-ticket, short-tenor credit products, addressing immediate financial needs and fostering a cashless economy. This initiative builds upon the September 2023 update that allowed scheduled commercial banks to link pre-sanctioned credit lines to UPI, now extending this facility to SFBs and amplifying its impact.

Both the CRR cut and the UPI credit line expansion demonstrate the RBI’s nuanced approach to managing the economy. While a rate cut ‘firework’ is currently unsuitable given inflation concerns, the ‘confetti’ of liquidity infusion and the expansion of UPI credit are strategic moves to support growth, enhance financial inclusion, and prepare the ground for future policy adjustments.

Will these measures be enough to reignite growth while keeping inflation in check? The effectiveness of these policies will become clearer in the coming months as we move towards the next earnings season and assess the real impact on both liquidity and credit access at the ground level.

Image Courtesy: X (RBI)

Leave a Reply