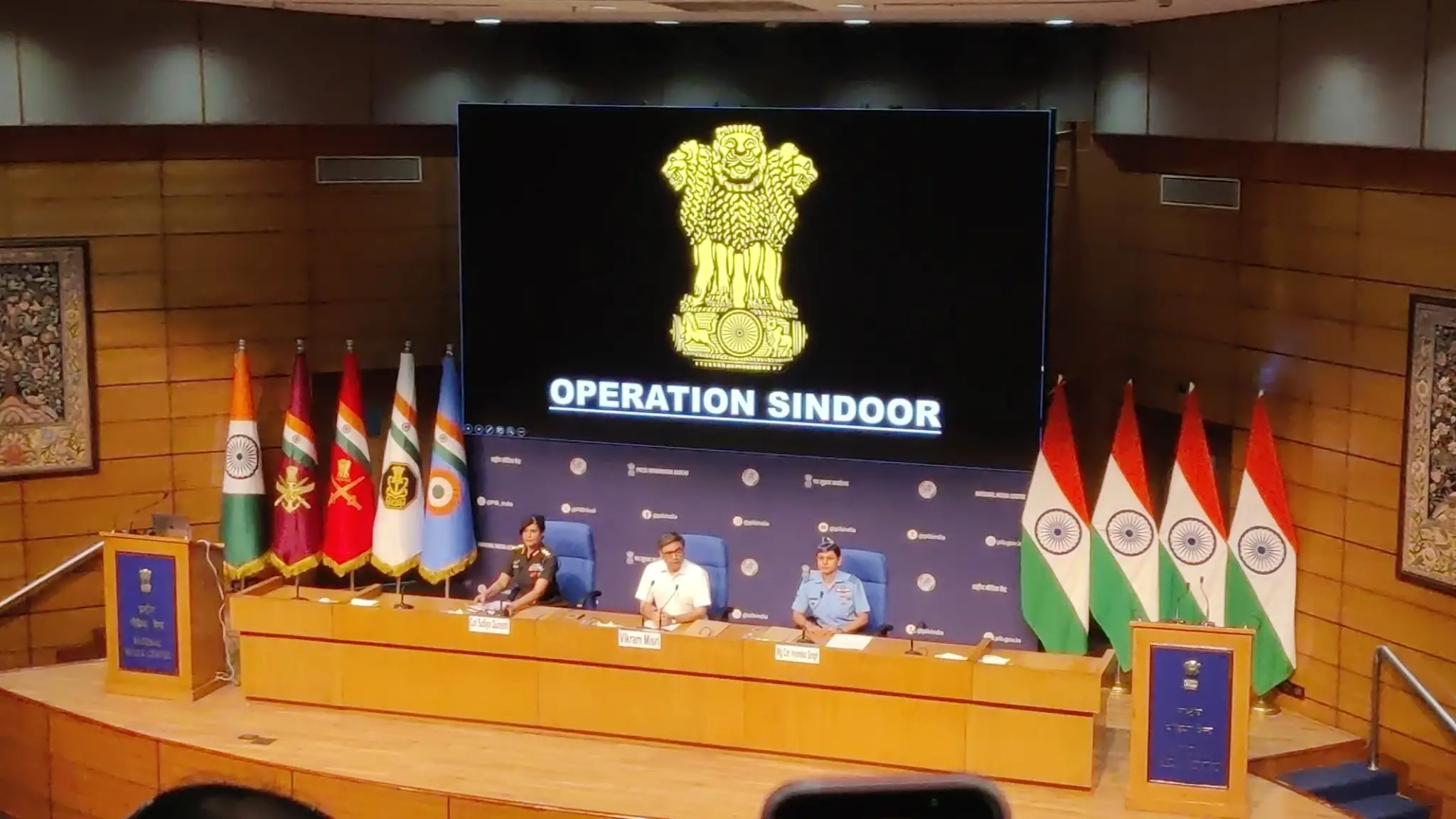

India’s launch of Operation Sindoor, precision airstrikes against terrorist sites in Pakistan and PoK, has predictably sent immediate ripples across the geopolitical and economic landscape. The operation, framed as a response to the recent Pahalgam attack, aims to be measured, but the impact on sentiment and certain sectors is undeniable.

The immediate aftermath saw Pakistan labelling the strikes an ‘act of war’ and closing its airspace, causing significant disruption. Northern Indian airports faced flight suspensions, hitting logistics and mobility hard. Companies like Air India, IndiGo, and SpiceJet were forced to cancel flights, a direct blow to the aviation sector.

Market Jitters Expected

On the financial markets front, volatility was the order of the day. The Sensex saw early losses, though it managed to erase some as the session progressed. History offers some guidance here. The 1999 Kargil War saw the Sensex dip around 5 per cent initially before recovering. More recently, the 2019 Balakot strikes resulted in a modest 0.7 per cent dip on the day, followed by a healthy 7 per cent rally over the next month. The Indian rupee also weakened against the US dollar, mirroring the 2019 trend when it depreciated 1.5 per cent. The rupee opened 19 paise weaker today.

The geopolitical tensions pose short-term challenges. Prolonged uncertainty or trade disruptions could deepen volatility. Foreign institutional investors (FIIs) might reduce exposure, as they did in 2019 after Balakot. However, domestic institutional investors (DIIs) continue to show confidence by remaining net buyers.

Sectors like aviation and tourism are clearly facing headwinds. Jammu and Kashmir’s tourism industry, already vulnerable, could see further revenue losses, echoing the 10 per cent drop in bookings to northern destinations seen during the 2019 Balakot crisis.

Defence Sector Rallies

On the flip side, defence stocks are gaining traction. Companies like Bharat Electronics, Hindustan Aeronautics, and Paras Defence are poised to benefit, a pattern observed in 2019 when defence stocks saw a significant rally driven by potential increases in defence budgets.

Energy markets are also watching closely. While not directly linked to Operation Sindoor itself, regional instability can impact global oil prices, potentially increasing India’s import bill.

Trade Deal Offers Long View

Against this backdrop of immediate geopolitical risk, there’s positive economic news. The India-UK Free Trade Agreement (FTA), covering $21 billion in bilateral trade, has been finalised. This significant deal aims to boost Indian exports in key sectors and attract UK investments. Analysts estimate it could add $50 billion to India’s GDP by 2030.

For investors, especially retail investors, panicking isn’t the answer. Historical data suggests resilience. Post-Kargil, GDP growth held steady at 6.1 per cent; post-Balakot, it was 6.8 per cent. Focusing on resilient large-cap stocks makes sense. Gold and government securities remain traditional safe havens, with gold prices rising 8 per cent during the 2019 tensions.

The UK FTA improves the long-term outlook for export-oriented sectors like pharmaceuticals and IT, making them attractive for those with a patient investment horizon.

What can markets expect? If de-escalation follows swiftly, as in 2019, investor confidence could return relatively quickly. The trade deal with the UK provides a positive, long-term economic anchor that could help stabilise sentiment even amidst short-term geopolitical choppiness.

Image Courtesy: X (Sidhant Sibal)

Leave a Reply