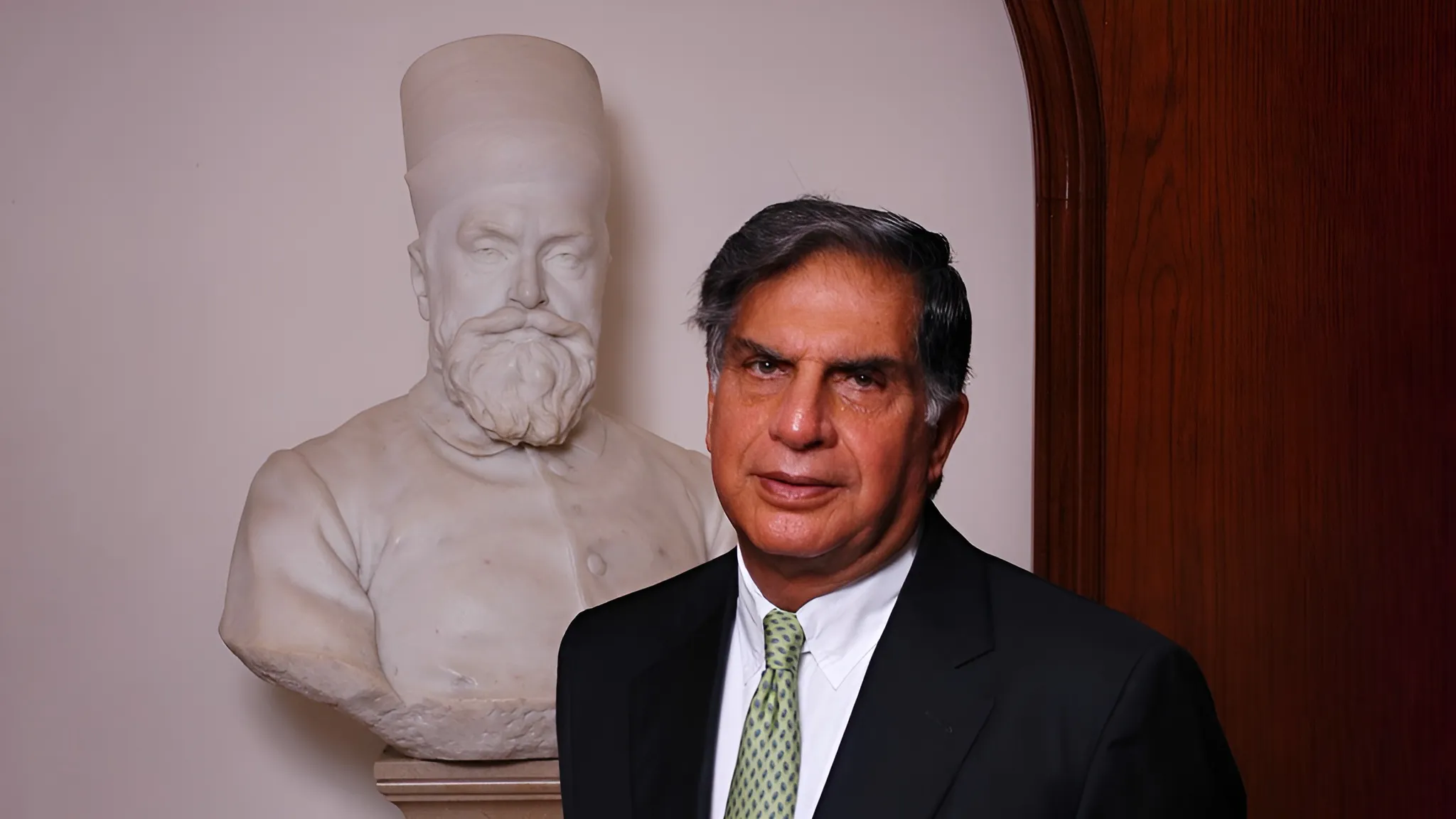

The recent passing of Ratan Naval Tata (RNT), a titan of Indian industry, invites reflection on the profound legacy he leaves behind. Beyond the balance sheets and business empires, it is the culture and values he instilled within the Tata group that stand as his most enduring contribution. For investors, the audacious, globe-trotting acquisitions under his stewardship remain a hallmark, a testament to a vision that was grand, even if its full potential is still unfolding.

Tata’s Visionary Acquisitions

From Tata Steel’s ambitious purchase of Corus Plc to Tata Motors’ strategic acquisition of Jaguar Land Rover (JLR), and Tata Tea’s foray into Tetley, RNT’s tenure was marked by transformative deals. These weren’t merely about expansion; they were about injecting global brands into the Tata ecosystem, broadening market reach, and fostering a culture of global competitiveness. Integrating these international giants brought invaluable lessons – the intricacies of developed market regulations, the imperative of innovation, and the relentless pursuit of operational excellence. The blending of diverse workforces also elevated human resource practices within the group.

RNT’s unwavering backing for these ventures, even through periods of turbulence like JLR’s Brexit and China challenges or Corus’ debt burden post the 2008 financial crisis, showcased his resilience. This fortitude, as recounted by Tata executives, empowered them to push boundaries and strive for success. Today, JLR contributes significantly to Tata Motors’ revenue and profit, while Tata Steel, adapting to India’s growing steel consumption, has strategically shifted its focus back to domestic markets. Even the re-acquisition of Air India, a sentimental homecoming, speaks volumes of his long-term vision.

China’s Contrasting Economic Shift

Contrast this with the present economic climate in China, where a stringent crackdown on sectors like finance, real estate, and technology is underway. This shift, driven by concerns over widening inequality and a renewed emphasis on socialist ideals under Xi Jinping, has led to a stark reversal for finance professionals. Once high-flying, many now grapple with frozen salaries and vanished bonuses, feeling like ‘rats’ in an industry under siege. Dozens of finance officials have faced detention, and a focus on ‘common prosperity’ is reshaping societal attitudes towards wealth accumulation. This environment stands in stark opposition to the growth-oriented, globally ambitious India that Ratan Tata helped shape.

Leadership Lessons in Changing Times

The contrasting narratives of Tata’s India and contemporary China offer crucial insights into leadership and adapting to evolving economic landscapes. RNT’s leadership was characterised by bold vision, risk appetite tempered by resilience, and a focus on long-term value creation rooted in strong ethical principles. His acquisitions, while ambitious, were strategic moves to enhance the group’s global standing and capabilities. China’s current approach, while addressing inequality, raises questions about its impact on innovation and economic dynamism. The Tata story underscores the power of visionary leadership in driving growth and building lasting institutions, while the Chinese scenario serves as a reminder of how swiftly economic priorities and societal values can shift.

Is the Tata leadership model, with its emphasis on ethical growth and global ambition, still relevant in a world grappling with economic uncertainties and shifting geopolitical landscapes? Absolutely. The principles of vision, resilience, and a commitment to values remain timeless. As India continues its growth trajectory, the lessons from Ratan Tata’s enduring legacy offer a valuable roadmap for navigating the complexities of the modern business world. His example suggests that true leadership lies not just in building empires, but in building them with integrity and a vision that serves a larger purpose.

Meta: Ratan Tata’s legacy of bold acquisitions contrasts sharply with China’s finance crackdown. Leadership and vision in changing economic landscapes analysed.

Image Courtesy: X (Ratan N.Tata)

Leave a Reply